Retirement Planner

Retirement Planner介绍

Retirement Planner helps you determine how much money you will need for your retirement to maintain the current lifestyle post retirement. You can give the Current Age, Retirement Age, Current Monthly Expenses, Expected Inflation, rate of returns on your investments before retirement and rate of returns on your investments after retirement.

Features

- Fields for Current Age, Retirement Age, Life Expectancy, Monthly Expenses, Inflation, Rate of Return on investment Before Retirement & After Retirement, Years to Retire, Yearly Expenses at retirement, Retirement Corpus, Monthly Investment

- Settings for Default Values - Currency Symbol, Rate of Return, Inflation, Retirement Age, Monthly Expenses & Reload Last Values

- Chart showing Monthly Investment, Yearly Retirement Income and Balance at End of every year in Retirement Corpus.

- Chart Save Chart Menu to save chart file in SD Card folder which user can attach in email.

- Hindi and Korean language added

- Existing Investment field added

- Lump sum investment required

- Monthly investment required

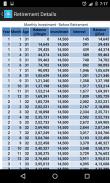

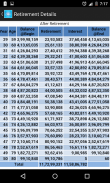

- Retirement Details Table with Investment required before retirement and Inflation adjusted Retirement Income after retirement.

- 2 new premium features added - Save as PDF and Email with PDF

- In app purchase for 1) App upgrade to Premium and 2) Remove ads

- Sample PDF file available at http://www.financialcalculatorsapp.com/Files/RetirementPlanner_sample.pdf

- Number formatting is now based on device locale

Age (Years) : 30

Retirement Age (Years) : 58

Monthly Expenses : 30,000

Inflation (%) : 7

Rate of Return (%) on investment Before Retirement : 15

Rate of Return (%) on investment After Retirement : 10

Year to Retire: 28

Monthly Expenses at retirement : 199,465

Yearly Expenses at retirement : 2,393,582

Retirement Corpus : 39,998,159

Monthly Investment : 7,719

Example:

Suppose you are 30 years old who wants to retire at 58 and expect to live till 80.

If your current Monthly Household Expenses (excluding expenses which will not be part of it post Retirement e.g. EMI, Insurance Premium, Education Expenses etc) are 30000,

You expect inflation to be around 7% for next 28 years,

You expect 15% return on your investments before retirement and

During retirement you expect that your investments will return 10%.

So Number of Years left for your retirement are 28 years and at retirement you will require a retirement corpus of 39,998,159 for which I need to save 7,719 per month.

Support

Please send your suggestion and issues to my E-mail address nilesh.harde@gmail.com

退休规划师可帮助您确定您将需要多少资金为退休维持目前的生活方式,退休后。你可以给当前的时代,退休的年龄,目前每月开支,预期通货膨胀,退休后你的投资回报率的退休和息前你的投资回报率。

特征

- 为字段目前的年龄,退休年龄,预期寿命,每月开支,通货膨胀率投资回报的退休前与退休后,年内退休,每年费用在退休,退休语料库,每月投资

- 设置默认值 - 货币符号,返回,通货膨胀,退休年龄率,每月开支及重载最后的值

- 图表显示每月投资,在每年的退休语料库结束年度退休收入和结余。

- 图表保存图表菜单保存图表文件,在其中用户可以在电子邮件中附加SD卡的文件夹。

- 增加了印地文和韩文

- 现有的投资领域添加

- 需要一次性投资

- 需要每月投资

- 退休详细信息表与投资退休后退休金和通胀调整后退休收入之前需要。

- 2新的高级功能的加入 - 另存为PDF和PDF电子邮件

- 在1应用程序内购买)应用程序升级到高级版和2)删除广告

- 样品在PDF可http://www.financialcalculatorsapp.com/Files/RetirementPlanner_sample.pdf文件

- 数字格式现在是基于设备的语言环境

年龄(岁):30

退休年龄(岁):58

每月支出:30,000

通货膨胀(%):7

收益率(%)投资退休前的15

收益率(%)投资在退休后的10

年退休:28

在退休时每月开支:199465

在退休时每年费用:2393582

退休语料库:39998159

每月投资:7719

例:

假设你是30岁谁愿意在58退休,并期望活到80。

如果您目前的每月家庭开支(不包括该不会是它的退休后如EMI,保险费,教育事业费等部分费用)是30000,

您预计通胀率将在7%左右明年28年

您希望在退休之前对您的投资15%的回报,

在退休后,你期待你的投资将恢复10%。

因此,年数离开你的退休28年,在退休时,你将需要为39998159,我需要节省7719每月退休语料库。

支持

请将您的意见和问题,我的E-mail地址nilesh.harde@gmail.com